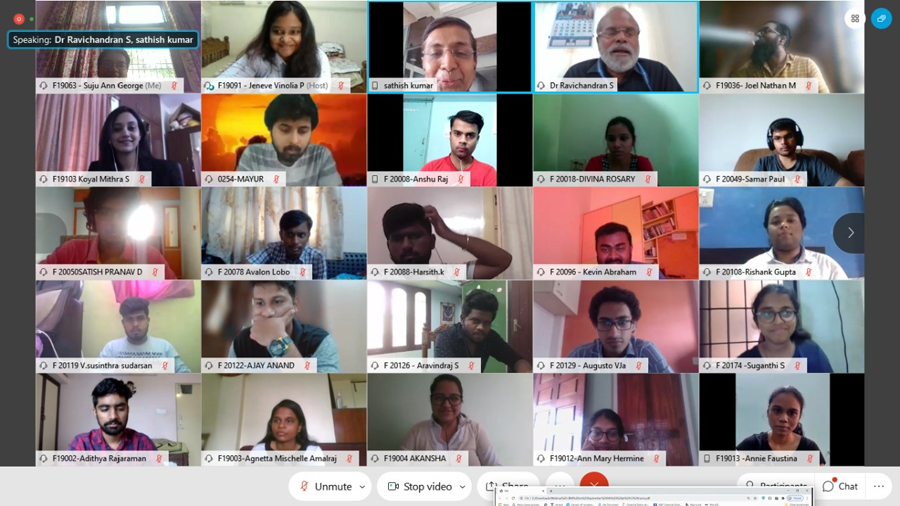

The BMI session conducted on 9th of September’20 was graced by Mr. Sathish Kumar, Head of Credit, Retail Assets, ICICI Bank Ltd., Mumbai. He spoke about the emerging technology in mortgages and housing loans in 2020.

The session began as the speaker told about how home-ownership and equity had been the key drivers of wealth, outpacing the other financial investments. With increase in interest rates and reduced affordable housing, the lenders are expected to follow the regulatory changes and keep up with the technological evolution. This creates an urgency among people to approach the situation with caution.

The leading banks in mortgages and housing loan sector include SBI, HDFC Ltd. and ICICI among many others. United States evolved as a prominent player by emerging successfully through all the technological disruptions. In spite of having a high market value, India is slowly evolving from paper into digital transactions. Digitalisation reduces cost especially in originating a mortgage, increases transparency and provides easy accessibility. He spoke on the different ways to create a mortgage, and the easiest methods to achieve it being cost effective.

Once the financial base had been set, the speaker told about how to establish a person’s identity through Know Your Customer (KYC) and the types of loan appraisal recommended based on the specifications in KYC documents. These processes can be made effective and efficient by revolutionising dematerialisation in the sector.

The speaker further elaborated on the top players within different sector and their evolving role in the transformation. Nucleus & TCS are the major players in end-to-end loan operating system; Perfios in bank statement analyser; Finfort in income analyser; Namaste Credit in loan appraisal; Probe 42 in insight of corporate or compilation of all information; CKYC in managing KYC records; Video KYC as an evolved digitised platform for KYC records; and Cersai as a tool for prospective buyers to check encumbrance status from online data base. With these initiatives as an example for dematerialisation, Mr. Sathish Kumar quoted,

“Whatever You Do, Do it With Perfection”

Artificial Intelligence and Machine Learning are slowly making its way into the banking and housing loan sector, to reduce the load of physical documentation. The Lenders can gain a competitive advantage by introducing technological advancements like AI and ML, which not only enhances the customer experience but also provides insight based financial recommendations.

The Beyond Management Initiative (BMI) session offers a unique opportunity for students to listen and interact with experts from diverse fields and thereby benefit from their significant experiences and valuable insights. The BMI lecture series are held every Wednesday in LIBA.